VAT (Value Added Tax) rates are the percentages of tax applied to goods and services. In hotels, VAT usually applies separately to different categories, such as Accommodation and Food & Beverage.

-

Accommodation VAT → The tax applied to room bookings.

-

Food & Beverage VAT → The tax applied to meals, drinks, or catering services.

Example:

If the VAT for accommodation is 6% and 20% VAT for food:

-

A €100 room will include €6 VAT.

-

A €50 dinner will include €10 VAT.

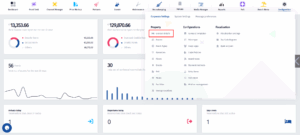

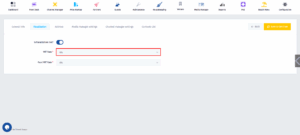

- Click on the Configurations icon.

- Once this menu pops up, click on General details.

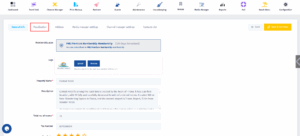

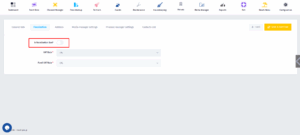

- Once you’ve been redirected to this page, click on Fiscalization.

- The first thing that you need to do is to turn the Is fiscalization live? switch on.

- Once you’ve done that, click on the VAT Rate dropdown.

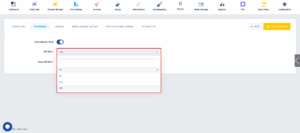

- Now you need to choose from the different VAT Rate percetages in the dropdown.

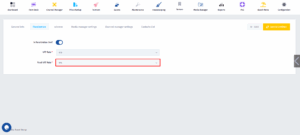

- After doing that, click on the Food VAT Rate dropdown.

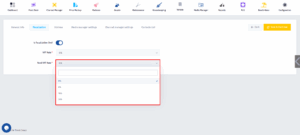

- Once the menu appears, pick the Food VAT Rate percentage of your choice.

- And for the last step, click on Save & Continue.

Leave a Reply